Great Plains Accounting Software Training: Master Your Finances!

Great Plains Accounting Software training equips users with the skills to navigate and utilize this platform efficiently. Through tailored courses, individuals or teams can master financial management using this software.

Great Plains, now known as Microsoft Dynamics GP, is a comprehensive accounting and ERP software solution widely used by small and mid-sized businesses. In the realm of financial software, being well-versed in such a robust system can significantly enhance productivity and reporting accuracy within an organization.

Training is available in various formats, including online tutorials, interactive webinars, and in-person classes, accommodating different learning preferences and schedules. These training sessions typically cover everything from basic navigation to advanced functionalities like customized reporting and system integration. Whether self-taught through online resources or guided by experienced trainers, mastering Great Plains Accounting Software can lead to improved business processes and financial clarity. With proper training, users can leverage the full potential of this dynamic accounting tool to streamline operations and support strategic decision-making.

Introduction To Great Plains Accounting Software

Great Plains Accounting Software, now known as Microsoft Dynamics GP, stands tall as an innovative and flexible financial management solution. Tailored for small to medium-sized businesses, this software streamlines accounting processes and offers insightful financial data management.

Origins And Evolution Over Time

Born in the 1980s, Great Plains Software revolutionized the way businesses handle finances. Evolving through technology advances, it became part of the Microsoft family in 2001, blooming into the robust Dynamics GP we know today.

Main Features And Their Benefits

Dynamics GP boasts a suite of impressive features. Each brings unique benefits that empower businesses to manage finances effectively. Key features include:

- Financial Management: Automate tasks, reduce errors, and get real-time insights.

- Inventory Management: Track stock levels accurately, avoid shortages and overstocking.

- Analytics and Reporting: Make informed decisions with data-driven insights.

Setting Up For Success

Embarking on your Great Plains Accounting Software Training journey begins with two critical steps: understanding the system requirements and mastering the installation process. Adequate preparation ensures a smooth transition into the world of Great Plains accounting. Stick with us as we lead you through each pivotal phase.

System Requirements And Installation

Before diving into Great Plains, ensure your computer is up to the task. Check the system requirements:

- Operating System: Windows 10 Pro or Enterprise

- Processor: Minimum 1.5 GHz x86 or x64

- Memory: At least 2 GB RAM for client, 4 GB for server

- Hard Disk: Minimum 2 GB of available space

Got what you need? Follow these installation steps:

- Insert the Great Plains CD or download the installer.

- Run

setup.exeand follow the on-screen instructions. - Choose the components you want to install.

- Restart your system to complete the setup.

Complete these steps and you’re geared up to go.

Navigating The User Interface

The Great Plains interface might seem complex at first, but fear not! Getting around is easy once you know how.

Let’s break it down:

- Home Page: Your personal dashboard for quick access to common tasks.

- Menus: Head to the top for menus with all the functions.

- Toolbars: Use these for shortcuts to frequent activities.

- Navigation Pane: On the left, find modules and areas you’ll work in.

- Task Panes: These are on the right, offering helpful actions and information.

Take your time to explore and click around. Comfort comes with practice.

Essential Financial Operations

Great Plains Accounting Software is a powerful tool for businesses. It simplifies financial tasks, ensuring accuracy and efficiency. Mastering essential operations is crucial for success. Let’s delve into creating accounts and handling transactions.

Creating And Managing Accounts

Account management is the foundation of financial operations. It includes setting up and organizing all accounts within the software. Ensure you understand the following steps:

- Set up company accounts accurately

- Organize accounts for easy monitoring

- Review account details regularly

Proper account management leads to a clear financial picture. Businesses can track their financial health effectively with well-organized accounts.

Handling Transactions And Invoicing

Transactions are daily activities in any business. Streamlining this process is vital. Learn to:

- Create and send invoices efficiently

- Process incoming and outgoing payments

- Reconcile bank statements with ease

Swift handling of transactions ensures a steady cash flow. Remember that accuracy in invoicing protects against financial discrepancies.

:max_bytes(150000):strip_icc()/mba.asp-final-d7d4beb9bf024c6aaa87adef5e8d95a9.png)

Advanced Features Of Great Plains

Exploring the powerhouse capabilities of Great Plains means delving into advanced features that transform daily accounting tasks. Advanced features amplify the basic functions, leading to remarkable efficiency and insight within businesses.

Customization And Automation

Great Plains software thrives on flexibility. Tailoring it to business needs is a breeze.

- User-defined fields adapt to unique data.

- SmartList Builder crafts personalized reports with ease.

- Macro capabilities, reducing repetitive tasks.

These tools increase precision and save time. Customized reporting presents data that talks, empowering decision-makers.

Integrating With Other Software Tools

Seamless connections across platforms mean Great Plains fits into any software ecosystem.

| Integration Ability | Tools Compatible |

|---|---|

| eCommerce | Shopify, Magento |

| CRM | Microsoft Dynamics CRM, Salesforce |

| Productivity | Microsoft Office Suite, Slack |

Dynamic integrations boost effectiveness by connecting data and teams. Great Plains befriends popular tools, streamlining complex workflows.

Best Practices And Troubleshooting

Great Plains Accounting Software training empowers users with the expertise to efficiently manage financial operations. However, mastering everyday use and resolving issues swiftly drives productivity. Adopting best practices and learning troubleshooting techniques ensures smooth software functioning.

Regular Maintenance And Data Backup

Regular software maintenance minimizes risks and enhances performance. Scheduled data backups prevent information loss during unexpected events.

- Update Software: Ensure Great Plains is up-to-date for latest features and security patches.

- Clean Data: Periodically review and clean data to improve system speed and accuracy.

- Backup Schedule: Implement a consistent backup schedule, safeguarding data against hardware failures or accidental deletion.

Automated backup solutions are available and highly recommended. Using these can save time and reduce errors.

Solving Common User Issues

Users may encounter various common issues while using Great Plains Accounting Software. Identifying and resolving these promptly maintains efficiency.

- Login Problems:

- Check user credentials and reset passwords if necessary.

- Verify user permissions and access rights.

- Data Integrity Errors:

- Run the built-in ‘Check Links’ utility to repair table relationships.

- Utilize ‘Reconcile’ feature to correct data discrepancies.

- Report Issues:

- Ensure all reporting tools are correctly installed and updated.

- Consult the software knowledge base for specific error messages.

Troubleshooting guides are available for detailed instructions on resolving complex issues.

Maximizing The Impact Of Training

Investing in training for Great Plains Accounting Software elevates user competencies. Proper training ensures efficient use of its features. To get the best from the training, embrace a plan. This enhances skills and boosts productivity.

Utilizing Online Resources And Community

Online platforms offer rich resources for learning. Users can access:

- Video tutorials for step-by-step guidance.

- User forums to share experiences and solutions.

- Guides and FAQ sections for quick answers.

Leverage these tools for a flexible learning experience. Engage with the Great Plains community online. This fosters learning from peers and experts alike. Search for reputable sites that offer free or subscription-based resources. Select qualitative materials that suit various learning stages.

Ongoing Learning And Certification Paths

Great Plains Software mastery calls for ongoing education. Users can pursue:

- Certifications to validate their expertise.

- Advanced courses for deeper knowledge on complex features.

- Regular webinars and workshops for updates on new functionalities.

Following a certification path ensures skill recognition. Certifications pave the way for career advancement. They demonstrate commitment to professional growth. Always check for the latest learning modules and certification requirements. Consider setting a training schedule to stay on track with continuous learning.

Frequently Asked Questions On Great Plains Accounting Software Training

Is Great Plains Being Discontinued?

Great Plains, now known as Microsoft Dynamics GP, is not being discontinued, but Microsoft has shifted focus to Dynamics 365.

What Is Great Plains Software Now Called?

Great Plains Software is now known as Microsoft Dynamics GP, after its acquisition by Microsoft in 2001.

Is Microsoft Dynamics The Same As Great Plains?

Microsoft Dynamics is not the same as Great Plains. Great Plains was rebranded as Microsoft Dynamics GP, which is part of the Dynamics suite.

What Is Replacing Microsoft Dynamics Gp?

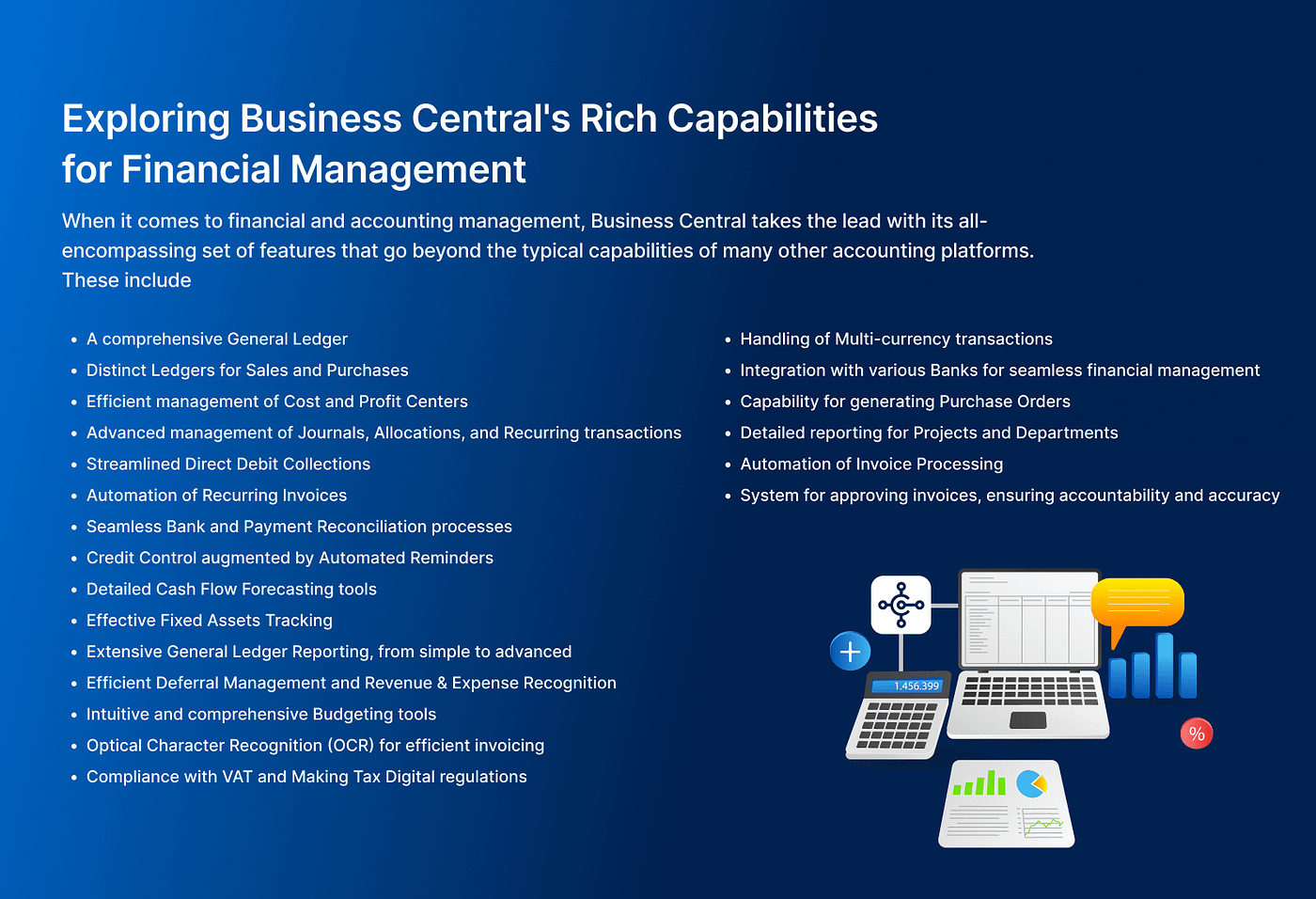

Microsoft Dynamics 365 Business Central is the modern cloud-based solution replacing Microsoft Dynamics GP. It offers expanded features and integration capabilities.

Embarking on a Great Plains Accounting Software training journey unlocks competitive edges for businesses and individuals alike. Mastery of this powerful tool boosts efficiency and financial clarity. Commit today to elevate your accounting prowess. Let’s harness the full potential of Great Plains together. Your strategic financial management awaits.